Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

![]() March 15, 2022

March 15, 2022

1、 Overview

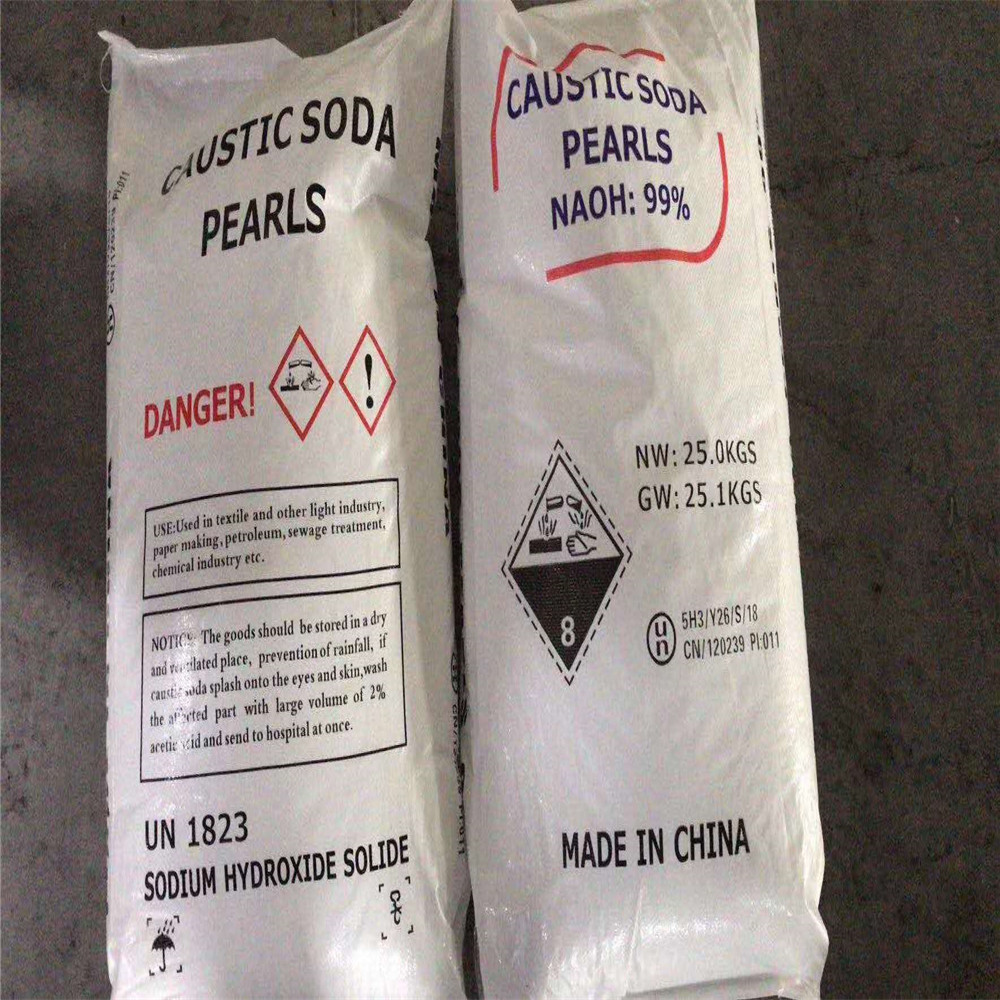

Sodium hydroxide is also called Caustic Soda,solid alkali. With strong alkalinity and strong corrosivity, it can be used as ACID neutralizer, coordination masking agent, precipitant, precipitation masking agent, color developer, saponification agent, peeling agent, Detergent, etc. There are two methods for industrial production of sodium hydroxide: causticization and electrolysis. Causticization can be divided into soda causticization and natural alkali causticization according to different raw materials; Electrolysis method can be divided into diaphragm electrolysis method and ion exchange membrane method.

2、 Industrial chain

1. Industrial chain structure

The main participants in the upstream of the industrial chain of caustic soda industry are raw materials, mainly raw salt, lime milk, graphite electrode and other raw materials; The middle reaches are caustic soda industry; The downstream is widely used in chemical industry, papermaking, food, Water Treatment, man-made fiber, metallurgy, soap and other industries.

2. Upstream end analysis

Raw salt is the main raw material for caustic soda production. China is rich in raw salt resources, which provides guarantee for the development of caustic soda industry. Due to the increasingly stringent environmental protection policies in China in recent years and the continuous promotion of supply side reform, the output of raw salt has gradually decreased. According to the data, in 2021, China's raw salt production fell to 51.546 million tons, a year-on-year decrease of 3.9%.

3. Downstream end analysis

At present, in the downstream consumption distribution of caustic soda in China, alumina is the industry with the largest demand, accounting for more than 30%. With the rapid growth of China's demand for building materials and caustic soda, China's construction industry has promoted the continuous growth of China's demand for building materials and caustic soda in recent years. According to the data, China's alumina output in 2021 was 77.475 million tons, a year-on-year increase of 5.9%.

3、 Industry status

1. Output

China is a large producer of caustic soda. With the continuous growth of downstream demand for caustic soda in China and the rapid development of chlor alkali industry, China's caustic soda industry is also increasing. According to the data, the output of caustic soda (100%) in China in 2021 was 38.913 million tons, a year-on-year increase of 6.8%.

2. Capacity

In terms of production capacity, according to the data, there were 158 domestic caustic soda production enterprises in 2020, 5 more than that in 2019 and 8 out; The total capacity was 44.7 million tons, an increase of 2.05 million tons over 2019, an exit of 1.15 million tons, and a net increase of 900000 tons. The production capacity is mainly concentrated in North China, Northwest China and East China, accounting for 81% of the country's total production capacity.

3. Demand

China's downstream consumption of caustic soda is mainly concentrated in alumina production in metallurgical industry, inorganic salt, organic chemical industry, pesticide and chlor alkali production in chemical industry, printing and dyeing and viscose fiber production in textile industry, papermaking in light industry and other fields. Among them, alumina industry is the largest demand field in the downstream of caustic soda, while construction industry and transportation industry are the two major consumption fields of alumina. In recent years, driven by the steady promotion of new urbanization, the demand for caustic soda in China has increased rapidly. According to the data, the demand for caustic soda in China reached 37.5447 million tons in 2021, a year-on-year increase of 6%.

4. Import situation

In terms of import, China's sodium hydroxide import volume and import amount were in an increasing trend from 2016 to 2019. Affected by the epidemic in 2020, the import volume and import amount decreased. With the effective control of the epidemic, the import of sodium hydroxide in China improved in 2021, with the import volume of 54700 tons, an increase of 25.5% year-on-year; The import amount was US $22.6 million, a year-on-year increase of 38.2%.

5. Export situation

In terms of export, China's sodium hydroxide export volume and export are in a downward trend in recent years, and the export volume and export amount have rebounded in 2021. According to the data, the export volume of sodium hydroxide in China in 2021 was 1.4838 million tons, with a year-on-year increase of 28.5%; The export value was 4338 million US dollars, a year-on-year increase of 38.4%.

4、 Competition pattern

At present, the market concentration of China's caustic soda industry is low, and the Cr5 of China's caustic soda industry is only 12.1% in 2020. Among them, Zhongtai chemical ranks first with a market share of 3%, followed by Xinfa group and Dadi salt chemical, with a market share of 2.6% and 2.4% respectively.

5、 Industry development trend

1. The industry has overcapacity and great pressure on environmental protection

With the continuous growth of China's economy, the scale of China's caustic soda industry has also expanded rapidly. The long-term "barbaric" expansion has caused serious overcapacity in China's caustic soda industry. Due to the large environmental pollution caused by the caustic soda industry, with the gradual tightening of China's environmental protection policies and the control of overcapacity industries in recent years, the growth rate of industrial capacity has slowed down significantly, but the problems of overcapacity and environmental pollution still exist. Therefore, in the follow-up development of the industry, how to reasonably adjust the industrial structure, eliminate backward production capacity, so as to realize the de production capacity of the industry, reduce energy consumption and improve the level of environmental protection capacity will be the key.

2. Demand growth drives industry development

With the advancement of China's new urbanization process and the upgrading of consumption structure, it has stimulated the investment in infrastructure and supporting construction, increased the demand for building materials, household appliances, clothing and daily necessities, and then stimulated the continuous growth of the demand for caustic soda products. In addition, construction and transportation are the two major consumption areas of aluminum, and with the promotion of lightweight transportation vehicles, the proportion will increase rapidly. The continuous development of automobile manufacturing industry, rail transit industry, aerospace industry and shipbuilding industry will directly stimulate the demand for industrial aluminum profiles, which will promote the continuous increase of domestic alumina output and the consumption capacity of caustic soda, further driving the development of China's caustic soda industry.

The above is the Analysis on the development status of China's caustic soda industry in 2021 we have listed for you. You can submit the following form to obtain more industry information we provide for you.

You can visit our website or contact us, and we will provide the latest consultation and solutions

Send Inquiry

Most Popular

lastest New

Send Inquiry

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.