Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

![]() January 31, 2024

January 31, 2024

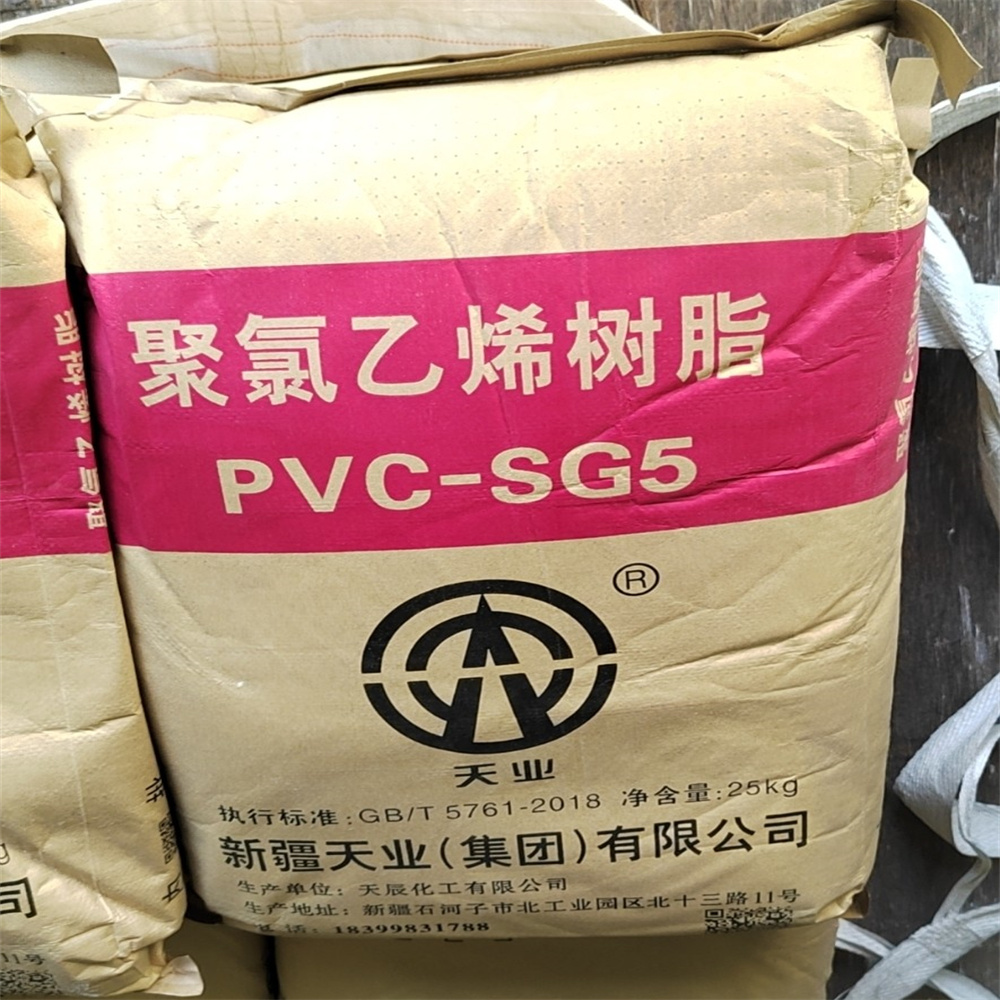

PVC, also known as polyvinyl chloride, is a polymer formed by the polymerization of vinyl chloride monomers with initiators such as peroxides and azo compounds, or under the action of light and heat, according to the mechanism of free radical polymerization. PVC is one of the largest general-purpose plastics in the world, widely used in various industries.

There are two main preparation processes for PVC production. The first is the calcium carbide method, which mainly produces raw materials such as calcium carbide, coal, and raw salt; The second is the ethylene method, with petroleum as the main raw material. The production of PVC in the international market is mainly based on the ethylene method, and in China, both the carbide method and the ethylene method coexist. However, due to the limitations of abundant coal, poor oil, and limited gas resources in China, the carbide method is mainly used. The calcium carbide process accounts for about 80%, mainly concentrated in the northwest and north China regions, and the price of calcium carbide has a significant impact on the cost of PVC; Ethylene method accounts for about 20%, mainly concentrated in the central and eastern regions. The production source of ethylene method is crude oil, and fluctuations in crude oil prices will directly affect the competitive relationship between ethylene method PVC and calcium carbide method PVC.

2. Upstream raw material analysis

(1) Oil market

International crude oil market: In 2023, the overall international crude oil market showed a high volatility trend, with the mainstream fluctuation range of US crude oil being between 70-90 US dollars per barrel. The sustained high volatility in the international crude oil market is formed in two major games: macro and fundamental. On the one hand, the Federal Reserve is facing high inflation pressure, constantly raising interest rates and reducing balance sheets. Although the pace of interest rate hikes by the Federal Reserve slows down as inflation declines, macroeconomic pressure still exists, creating downward pressure on crude oil market prices; On the other hand, with market concerns about the Federal Reserve's continuous interest rate hikes and balance sheet tightening, the global economy will face downward risks. In order to avoid this risk, the OPEC+alliance represented by Saudi Arabia has continuously reduced production to support the oil market, especially Saudi Arabia's voluntary additional production cuts, which have made the supply side of the market relatively tight. Therefore, in the game process of macro downturn and fundamental supply side production reduction support, the crude oil market continues to fluctuate at high levels.

Domestic crude oil market: In 2023, China's economy will steadily develop, and the petrochemical industry will develop with high quality. China's major oil production data has maintained year-on-year growth, with crude oil production, processing volume, and import volume achieving a simultaneous increase of three quantities. According to data from the National Bureau of Statistics, the General Administration of Customs of China, and Zhuochuang Information, from January to September 2023, China's crude oil production was 156.72 million tons, an increase of 1.9% year-on-year; The crude oil processing volume was 557.4956 million tons, an increase of 12.62% year-on-year; The import volume of crude oil was 42.427 million tons, a year-on-year increase of 14.6%. According to data from the General Administration of Customs of China, the total amount of imported crude oil in China from January to September was 424.27 million tons, a year-on-year increase of 14.6%; It is expected that the annual crude oil import volume will exceed the level of 2020, reaching a historical high of 580 million tons/year, and China's dependence on foreign crude oil will always remain above 70%.

In recent years, the Chinese economy has continued to develop rapidly, and China has become the world's largest consumer and importer of oil. In order to meet the growing demand for oil and the increasing importance of domestic energy security, domestic oil companies have increased their crude oil production and seized the opportunity to take advantage of the "window period" of international oil price decline. On the one hand, they have actively increased their purchasing power for low-priced crude oil from oil producing regions such as the Middle East, and significantly increased their crude oil imports; On the other hand, promoting the rapid development of the new energy industry and accelerating the construction of petroleum infrastructure, mainly including national petroleum reserve bases, coastal commercial crude oil reserve warehouses, and 350000 ton crude oil terminals.

(2) Calcium carbide market

The calcium carbide market is sluggish, and cost support continues to weaken. The imbalance in the supply and demand structure of the calcium carbide market has led to a continuous decline in prices. The calcium carbide market began to adjust from October 2021, with a fluctuating focus and a decline. Due to frequent changes in the supply and demand relationship in the calcium carbide market, it can be seen from the price trend that there is an interactive trend of ups and downs. At the end of 2022, the price of calcium carbide in the market gradually dropped below 4000 yuan/ton. In 2023, the trend of the calcium carbide market remained sluggish, showing a trend of rising and falling. In the first half of January, the calcium carbide market experienced a brief rise, mainly boosted by the improvement of the downstream PVC market, with increased support from rigid demand. But starting from late January, the price of calcium carbide has rapidly declined. After resuming production at a high level, calcium carbide production enterprises have maintained stable operation, with high calcium carbide production and abundant market supply. However, the PVC market is not good, and under the pressure of its own costs and losses, negative feedback is formed upwards, suppressing the trend of calcium carbide. Although there is an increase in production capacity in the PVC market, there has not been a significant increase in overall consumption of calcium carbide. Most of the time, downstream PVC companies have a high number of trucks waiting to be unloaded, and they control the arrival volume by lowering procurement prices. As the price of calcium carbide continues to fall, calcium carbide enterprises are facing significant cost and shipping pressures. The phenomenon of load reduction or parking will drive a phased improvement in the market. However, the price increase in the calcium carbide market is difficult to sustain, and the overall operating range has shifted downwards. The adjustment of the calcium carbide market continued until June, with prices in multiple regions falling below 3000 yuan/ton, continuously hitting new year lows. In the second half of the year, the calcium carbide market slightly improved, with the focus initially rising and then falling, mainly influenced by the trend of the PVC market.

Entering the third quarter, the operating rate of calcium carbide enterprises reached a low level, but with the end of the spring inspection of downstream PVC enterprises, downstream demand began to improve, and the price of calcium carbide experienced a significant rebound, gradually rising to 3350 yuan/ton in mid September. The price increase has driven up the operating rate of calcium carbide enterprises. Entering the fourth quarter, the new production capacity of calcium carbide gradually landed, but due to downstream autumn maintenance, insufficient downstream demand, high calcium carbide inventory, and another decline in calcium carbide prices.

From the perspective of production capacity, calcium carbide is a high energy consuming and high emission industry, and the growth of calcium carbide production capacity will slow down due to policies such as environmental protection restrictions, energy consumption control, and clearing outdated production capacity. In 2023, the new production capacity of calcium carbide will be around 2.3 million tons. According to statistics, the production capacity of calcium carbide in 2023 is 43.25 million tons, with a production volume of 27.5 million tons. The current under construction and planned calcium carbide projects have a production capacity of about 9 million tons per year, and it is expected to release 3.8 million tons per year of new production capacity from 2023 to 2024, which may have a greater impact on the market.

From a supply perspective, according to the statistics of the China Calcium Carbide Industry Association, the top ten calcium carbide enterprises in the industry have a total production of 9.51 million tons. As of 2022, the number of carbide production enterprises in China has decreased from over 400 in 2008 to 116. At present, calcium carbide enterprises are operating at a low level, and the price of calcium carbide is fluctuating near the cost line. It is expected that the price of calcium carbide will further decline in early 2024.

From the perspective of market demand, the main downstream product of calcium carbide is PVC. The production capacity growth rate of the PVC industry in 2024 is still not high. However, with the continuous investment of new BDO production capacity in China and the continuous exploration of emerging downstream industries, the demand for calcium carbide may increase. The calcium carbide industry will face challenges such as demand structure transformation.

We are specialized in basic chemicals manufacture and distribution.We offer Pvc Resin SG3,PVC Resin SG5,PVC Resin SG8, PVC RESIN S1000 .

The above is the Market analysis of PVC raw materials we have listed for you. You can submit the following form to obtain more industry information we provide for you.

You can visit our website or contact us, and we will provide the latest consultation and solutions

Send Inquiry

Most Popular

lastest New

Send Inquiry

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.