Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

![]() August 29, 2022

August 29, 2022

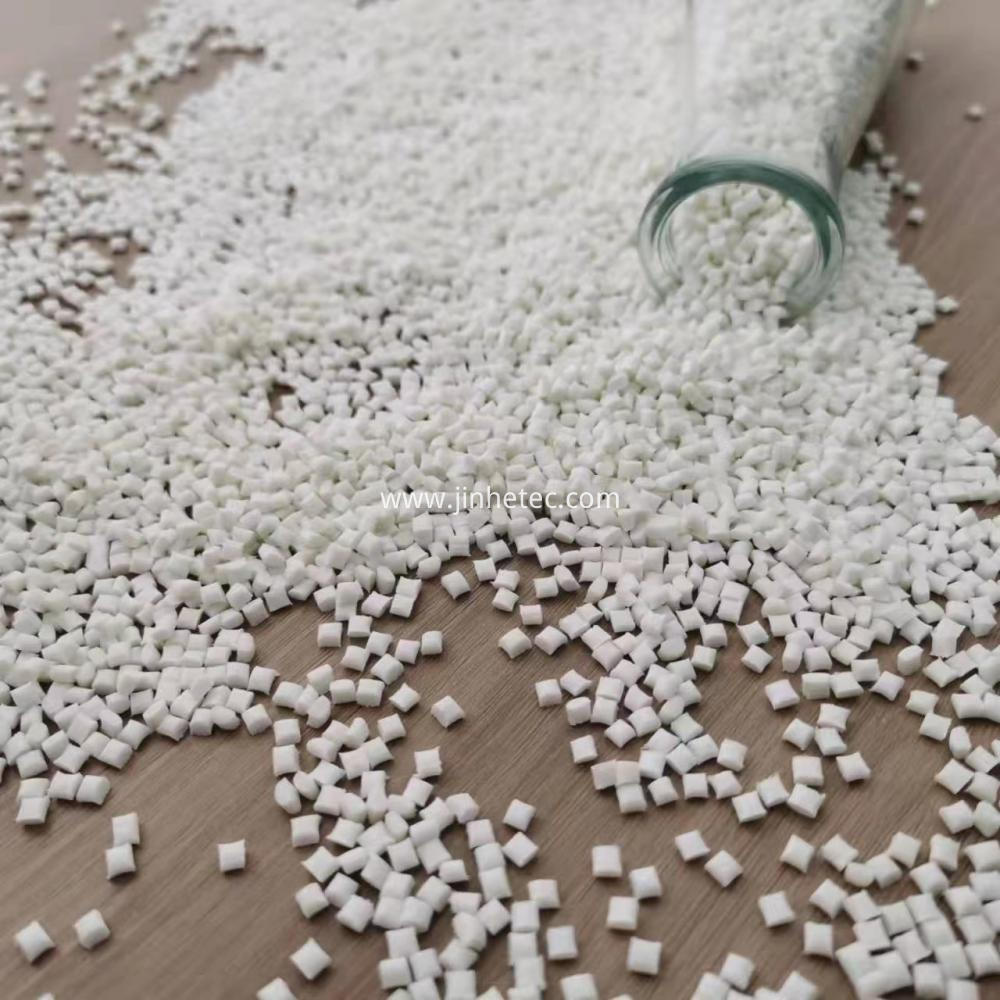

Polyester (PET), i.e. polyethylene terephthalate, is a fiber-forming polymer obtained by melt direct spinning polymerization with PTA and ethylene glycol as raw materials. The production of 1 ton of polyester requires 0.855 tons of PTA and 0.335 tons of ethylene glycol. Among the polyesters, the output of polyester fiber is the largest, accounting for 75%, the proportion of polyester bottle chips is 20%, and the proportion of polyester film is 5%. Polyester fiber is used to make clothing and home textile fabrics, polyester bottle film is used to make beverage bottles, especially carbonated beverage packaging, and polyester film is used to make packaging materials, films and tapes.

Polyester raw material - ethylene glycol

Ethylene glycol is an important basic organic raw material for petrochemical industry. The terminal raw materials of ethylene glycol in the world are crude oil, shale gas, petroleum gas, coal and other energy commodities. There are mainly two industrial production routes of ethylene glycol: ethylene method and coal based synthesis gas Oxalate method, of which ethylene method accounts for the largest proportion, accounting for 64.66%, followed by coal based synthesis gas method. Ethylene production is subdivided into naphtha production, ethane cracking production and methanol production. These two production routes involve raw oil, ethane, coal and other raw materials, of which the capacity of oil head ethylene glycol accounts for the majority. Therefore, crude oil price has a great impact on ethylene glycol. In terms of import and export, ethylene glycol mainly relies on imports to support the demand. The import volume accounts for about 1 / 3 of the total supply of ethylene glycol. The main importing countries are Saudi Arabia and Canada. In June 2022, the domestic dependence on ethylene glycol import was 37.93%, and the import volume was 646400 tons. In terms of downstream demand, the downstream consumption of ethylene glycol is mainly concentrated on polyester filament, accounting for 50.44%, followed by polyester bottle chips, accounting for 17.8%, and polyester chips, accounting for 14.28%.

China is one of the largest producers of ethylene glycol in the world. The main production capacity of ethylene glycol is concentrated in East China, accounting for 53.14%. The top provinces in domestic production are Zhejiang, Jiangsu, Guangdong, Fujian, Shanghai, Tianjin, Henan and Inner Mongolia. For a long time, ethylene glycol units are mainly concentrated in PetroChina and Sinopec, of which Sinopec accounts for the largest proportion of production capacity, and the rest are distributed in ethylene process and coal production enterprises. In the first half of 2022, the total output of ethylene glycol will be 6.8653 million tons, and that of 2021 will be 11.9079 million tons, both of which are at a high level in recent years. The annual capacity of ethylene glycol in 2021 will be 20.811 million tons, and that in 2020 will be 15.681 million tons, an increase of 32.71% year-on-year. The growth rate of capacity will be lower than that in 2020. Among them, the monthly output of coal to ethylene glycol in 2022 is at a high level in recent years, with a maximum of 405600 tons per month. The annual output of coal to ethylene glycol in 2021 accounts for 26.57% of the total output, and that of ethylene to ethylene glycol in 2021 accounts for 64.66% of the total output.

Polyester raw material - PTA PTA PTA is the end product of crude oil. The crude oil is processed to produce naphtha through certain processes. MX is extracted from the naphtha, and then PX (p-xylene) is extracted. Finally, PX is made into PTA through catalytic oxidation process. PTA (catalytic oxidation process) cost composition = p-xylene PX * 0.66 + processing fee. The correlation between PTA and crude oil is 0.78, and the correlation between PTA and PX price is 0.91. In terms of import and export, PTA is mainly exported, but the proportion is relatively low. The export dependency is 9.58%, and the export in June was 390000 tons; The import of raw material PX accounts for a large proportion, accounting for about 1 / 3 of the total supply. In terms of apparent consumption, China's PTA consumption increased from 15.29 million tons in 2008 to around 52.3 million tons in 2021, with an average annual consumption growth rate of 9.6%, exceeding the average GDP growth rate in the same period.

The distribution and concentration of domestic PTA production capacity is high. PTA production capacity is mainly concentrated in East China, accounting for 64.91%. From the perspective of geographical distribution, it is mainly distributed in Liaoning, Zhejiang, Jiangsu and Fujian. The PTA capacity of these four regions accounts for 83% of the total capacity. From the perspective of enterprise distribution, Yisheng petrochemical, Hengli Petrochemical (600346), xinfengming (603225) and Fuhua industry and trade are the mainstream suppliers of PTA, accounting for 54% of the total production capacity. In 2021, the annual capacity of PTA will be 66.29 million tons, an increase of 16.11% over 2020; In 2021, the annual output of PTA was 51.7 million tons. In the first half of 2022, the output was fluctuating, totaling 29.81 million tons. In 2022, the PTA output was at a historical high level.

Polyester terminal demand

From the perspective of downstream products, the main products of China's polyester industry are polyester (filaments and staple fibers), accounting for more than 65%. Polyester filaments can be used to produce civil filaments and industrial filaments, of which civil filaments account for the majority, and are subdivided into polyester filament POY, polyester filament FDY and polyester filament DTY. The downstream products of staple fibers are spinning. From the demand field, polyester is mainly used in the textile and clothing field, accounting for 76%. In addition, polyester is used for food packaging, daily chemical packaging and fresh cold chain packaging, accounting for 24%. From the perspective of capacity distribution, the domestic polyester industry capacity is mainly distributed in Jiangsu and Zhejiang. In 2021, the capacity of Jiangsu and Zhejiang is 51.3 million tons, accounting for 77.2% of the total polyester capacity. The rest of the capacity is distributed in Fujian, Guangdong and other places. In recent years, the domestic polyester production capacity has shown a gradual upward trend. In 2021, the polyester production capacity was 66.445 million tons, but the year-on-year growth rate decreased.

The demand for terminal textile and clothing was suppressed by the epidemic, the global economic downturn and the "three mountains" with the inventory cycle peaking, and entered a medium and low-speed growth state. Under the influence of high-temperature power limitation, the start-up of Jiangsu and Zhejiang terminals has dropped significantly, the downstream polyester load has rebounded, the orders are still weak, and the downstream polyester filament is in a high inventory state. From January to July 2022, due to the constraints of raw materials and the weak terminal demand, the overall supply and demand of the polyester industry chain are weak, and the polyester industry is subject to the pressure of high cost of upstream raw materials.

The above is the Polyester industry chain we have listed for you. You can submit the following form to obtain more industry information we provide for you.

You can visit our website or contact us, and we will provide the latest consultation and solutions

Send Inquiry

Most Popular

lastest New

Send Inquiry

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.