Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

![]() February 28, 2024

February 28, 2024

Caustic Soda industry chain:

The upstream is raw salt electrolysis, while the downstream mainly includes alumina, chemical industry, papermaking, textile printing and dyeing, etc.

Salt chemical industry chain:

Consisting of the chlor alkali industry chain and the soda ash industry chain, the common upstream of the two is raw salt, and there is a small substitution relationship between caustic soda and soda ash.

The main products of the chlor alkali industry chain include caustic soda, PVC, liquid chlorine, and calcium carbide. The main products of the soda ash industry chain are soda ash and glass, with the main downstream of glass being architectural glass and automotive glass.

Introduction to caustic soda foundation

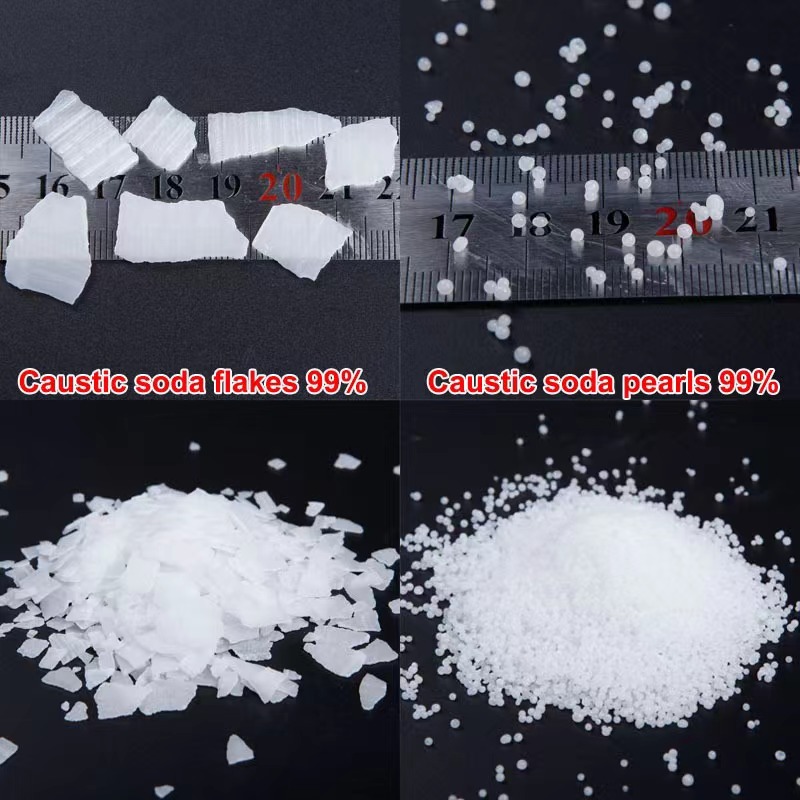

Sodium Hydrate (SH): also known as caustic soda or caustic soda, is an inorganic compound NaOH. Morphological classification: liquid alkali, solid alkali. Physical properties: White crystalline powder, colorless and transparent in aqueous solution; Extremely soluble in water, ethanol, glycerol, insoluble in acetone, ether; A large amount of heat is released during dissolution. Chemical properties: Strong alkaline permeability, reacts with metallic aluminum and zinc, non-metallic boron and silicon to release hydrogen, etc; Has corrosiveness; Strong water absorption, used as an alkaline desiccant; Dissolve non cellulose and do not react with cellulose (papermaking); React with oxides to generate soluble sodium salts (for producing alumina); Adjust pH value through ACID-base neutralization (Water Treatment).

Alkali production process: Ion membrane method accounts for 99.6% of the total, and the outlet concentration is between 30% and 35%

Ion exchange membrane method: electrolyzing salt water to generate caustic soda, hydrogen gas, and chlorine gas; The energy consumption is mainly concentrated in the electrolysis process.

Ionic membrane method process: raw salt - brine refining and filtration - electrolysis to produce liquid alkali (cathode chamber); Further evaporate and thicken to obtain solid alkali. Energy consumption: mainly concentrated in the electrolysis process.

Solid alkali: rectified by 2%; Salt water refining by 3.9%; Electrolysis 53.2%; Chlorine hydrogen treatment at 1.2%; Liquid alkali evaporation 25.1%; Solid alkali production is 14.6%.

Liquid alkali: Electrolysis accounts for 90% (53.2/(2+3.9+53.2)).

Transportation methods: pipeline transportation, truck transportation, rail transportation, water transportation; Pipeline transportation is used within the park, and transportation within 300 kilometers is by car. For longer distances, shipping or railway transportation can be used.

32% liquid alkali uses ordinary carbon steel storage tanks and tankers

50% liquid alkali storage tanks require the use of nickel containing stainless steel tank trucks

Both liquid and solid alkali transportation vehicles must be equipped with hazardous material identification and escorts

Must have the qualification for transporting hazardous chemicals (with complete "three certificates")

Carrier company: Dangerous Goods Road Transport License

Vehicle: Dangerous chemical transportation vehicle operation certificate

Personnel: Qualification certificates for drivers and escorts

Alkali storage: Liquid alkali storage tank for storage, solid alkali plastic bag packaging, attention to water drainage and moisture prevention

Liquid alkali: stored in storage tanks; The tank capacity is generally between 4000-7000 cubic meters per tank

32% liquid alkali is stored in ordinary carbon steel tanks, with an inner layer coated with anti-corrosion protective film

50% of liquid alkali storage tanks use nickel containing stainless steel tanks, and most of them have insulation devices

Storage fee of 1.2-1.7 yuan/ton/day

Solid alkali: often packaged in plastic bags. Inner bag made of polyethylene and Polypropylene film; Outer bag: polyethylene, polypropylene woven bag or kraft paper bag

Store in a ventilated, dry, and clean warehouse, and do not store with flammable materials and acids

Storage fee of 1-1.4 yuan/ton/day

Inventory caustic soda undergoes quality testing at least once a quarter

Chlorine gas: a highly toxic gas with a strong irritating odor. It is yellow green at room temperature and pressure, has a higher density than air, and is soluble in water. Chlorine gas is easily compressed and can liquefy into a golden oily liquid. After liquefaction, its volume greatly decreases, making it easy to transport and store. It is commonly referred to as "liquid chlorine".

Liquid chlorine: One of the main products in the chlor alkali industry, with strong oxidizing and corrosive properties, is a good combustion aid. Widely used in industries such as metallurgy, textiles, and papermaking, it is also an important raw material for synthesizing products such as hydrochloric acid, polyvinyl chloride, plastics, and pesticides.

Liquid chlorine transportation and storage: At room temperature, once liquid chlorine leaks, it will immediately vaporize and is prone to react with other gases or liquids, leading to the production of highly toxic gases. Therefore, tank trucks or high-pressure sealed steel tanks are generally used for transportation. Tank trucks typically weigh 25 tons per tank, and high-pressure sealed steel cylinders typically have a net weight of 500KG or 1000KG.

Transportation precautions: Possess hazardous chemical transportation qualifications (with complete three certificates).

National policy requirements: The actual storage time of liquid chlorine steel cylinders in the warehouse shall not exceed three months; The total storage capacity of liquid chlorine storage tanks in liquid chlorine production enterprises should not exceed the total normal production capacity of the enterprise in three days; The storage capacity of liquid chlorine per unit should not exceed the total normal usage of 7 days per unit. After 2025, the trade of commodity liquid chlorine will gradually disappear, and liquid chlorine will be basically digested within the park.

Chlorine alkali balance: As caustic soda and liquid chlorine are co produced in a fixed proportion, theoretically, for every 1 ton of caustic soda produced, 0.8875 tons of chlorine gas can be produced. After a series of reaction processes, 1.56 tons of Pvc Resin can be produced. In fact, the wet chlorine gas generated during the electrolysis process undergoes dechlorination treatment and PVC production losses, resulting in a chlor alkali ratio close to 1:1 at the output end; The production of caustic soda and PVC Resin in chlor alkali plants is generally at a ratio of 1:1.25, which means that for each ton of PVC produced, a combined production of 0.8 tons of caustic soda is required.

In terms of storage and transportation, liquid chlorine is inconvenient to store and transport, and must be consumed in a short period of time after production. Compared to liquid chlorine, caustic soda is easier to store and transport over long distances. In terms of demand, the demand for liquid chlorine is mainly limited by downstream consumption devices, and caustic soda products are mostly sold externally.

Cost of chlor alkali (ECU cost)=(2200-2400) * Electricity price+1.51 * Raw salt price+(400-550) (calculated per ton of caustic soda)

ECU cost accounting: Calculate the total cost of ECU, and allocate the cost to caustic soda (53%) and liquid chlorine (47%) based on a ratio of 1 caustic soda to 0.885 liquid chlorine

1 electrolysis unit (ECU) profit=0.885 chlorine gas price+1 caustic soda (converted to 100%) price - chlor alkali cost, i.e. 1 ECU=0.885 Cl2+1 NaOH

Cost of caustic soda (converted to 100%)=53% * ECU cost; Liquid chlorine cost=47% * ECU cost

Note:

1. The production cost of caustic soda varies greatly in different regions, mainly influenced by differences in energy structure (electricity prices), raw material and labor costs.

The cost of solid alkali is about 400-500 yuan/ton higher than that of liquid alkali. Liquid alkali needs to be further concentrated to produce solid alkali, whether it is the falling film flash evaporation method or the large pot boiling method, which incurs fuel (coal, heavy oil, hydrogen) and electricity consumption, as well as additional labor costs.

Based on the production process of raw salt electrolysis, enterprises produce caustic soda and liquid chlorine through co production. About 40% of caustic soda enterprises produce PVC with liquid chlorine as a supporting product, while the remaining 60% sell liquid chlorine to other downstream enterprises (such as hydrochloric acid, epoxy propane, etc.); More than 95% of PVC enterprises are equipped with caustic soda facilities.

In terms of profit accounting, caustic soda enterprises (non supporting PVC devices) consider production based on chlor alkali profit, while caustic soda enterprises (supporting PVC devices) consider production based on the comprehensive profit of PVC+caustic soda.

(1) Caustic soda (non matching PVC equipment, accounting for 60%) enterprise profit=ECU profit

(2) Caustic soda (supporting PVC equipment, accounting for 40%) enterprise profit=PVC profit+caustic soda profit (adjustable)

Note: Due to the basic supporting liquid chlorine production equipment of PVC enterprises, the profit of liquid chlorine can be reflected in PVC profit or chlor alkali profit (ECU) profit, and then converted to PVC cost according to market price.

If PVC incurs losses but the price of liquid chlorine delivery is high, the enterprise may reduce PVC production to deliver liquid chlorine; If PVC is profitable and liquid chlorine is subsidized for sales, the profit of caustic soda may be poor. The enterprise may maintain a low production rate of caustic soda and increase the PVC load by purchasing liquid chlorine externally. The trade attributes of liquid chlorine commodities will disappear in the future.

Limited substitution relationship between substitutes - caustic soda and light caustic soda (less than 5%)

The commonality between caustic soda and soda ash is that they contain sodium ions and are alkaline, and they have a certain substitution relationship in some downstream industries (such as alumina, caustic soda, monosodium glutamate, detergents, etc.). The substitution core lies in the relative price. In theory, when the price of light alkali * 1.325>the price of caustic soda converted to 100%, manufacturers using caustic soda have a relative cost advantage compared to light alkali; In fact, the industry often compares the price of light alkali * 1.35-140 with the discounted price of caustic soda.

By comparing and calculating the main substitutable downstream fields such as alumina and caustic soda, as well as the regional substitution prices, it can be seen that Southwest, Northwest, and South China have partial substitution advantages for caustic soda. In theory, the substitutable amount is about 1.25 million tons, accounting for 3.5% of the surface demand of 36 million tons.

Global supply-demand pattern

Global production capacity trend: divided into three stages as a whole, with rapid growth in production capacity from 2004 to 2013, decline in production capacity from 2014 to 2016, and stable growth from 2017 to 2022. The overall growth rate of global caustic soda production capacity fluctuated between 4% and 6% from 2004 to 2013, with the production capacity growth rate approaching 10% in 2012. Since 2013, global caustic soda production capacity has gradually slowed down, and by 2016, the growth rate of production capacity had reached negative growth. Afterwards, the global caustic soda industry has re formed a stable growth pattern.

Except for 2014-2016, the global caustic soda production capacity has maintained steady growth since 2002-2022, but the growth rate of production capacity has significantly slowed down since 2016. The growth of production capacity mainly relies on China and the United States. In recent years, new production in Southeast Asia has maintained growth, while production capacity in Western Europe has tended to decrease.

As of 2022, the global caustic soda production capacity has reached 103.53 million tons, mainly concentrated in Northeast Asia, North America, and Europe. In 2022, the production capacity of the three regions accounted for 54%, 16%, and 12% respectively; Since 2006, China's caustic soda production capacity has steadily ranked first in the world, accounting for 45.7% in 2022.

Global production capacity is mainly concentrated in Northeast Asia (China), North America (United States), and Western Europe. This distribution feature is consistent with the PVC production capacity distribution.

Production distribution: In 2022, global caustic soda production is mainly distributed in China (46.3%), North America (16.3%), and Western Europe (12.1%), accounting for 74.7% of global caustic soda production.

Production changes: In various regions around the world, the production of caustic soda in China, South Asia, Southeast Asia, the Middle East, and Africa continues to increase, while the overall production of caustic soda in Western Europe has decreased.

Global caustic soda consumption continues to grow: Except for 2009 (financial crisis) and 2020 (epidemic), global caustic soda consumption continues to grow, with a CAGR of 1.44% in the past five years. The growth rate of consumption is gradually decreasing: from the perspective of the growth rate of caustic soda consumption, it was approximately 4% -6% from 2002 to 2012, 2% -4% from 2013 to 2017, and 0-2% from 2018 to 2022.

The main consumption regions are China, North America, Western Europe, South Asia, and Southeast Asia. China is the largest consumer of caustic soda, accounting for 44.8% of global consumption in 2022.

Changes in caustic soda consumption in various regions: caustic soda consumption in China, South Asia, and Southeast Asia has increased significantly, while caustic soda consumption in North America and Western Europe has remained stable.

Consumption structure: Aluminum oxide, pulp, organic chemistry, and textiles are the main downstream industries, with aluminum oxide accounting for 25.7% in 2022.

Changes in consumption structure: The proportion of alumina continued to rise from 2002 to 2016, and the downstream consumption structure of global caustic soda has remained stable in the past five years. The proportion of inorganic chemicals has slightly increased, while the proportion of light industry (soap, bleach, etc.) has slightly decreased. Benefiting from the continuous expansion of China's alumina production capacity, the proportion of alkali consumption in alumina continues to increase.

Global trade structure: The main outflow destinations for caustic soda are the United States, Northeast Asia, Western Europe, and the Middle East, where production is relatively concentrated.

United States: self-sufficient, partially exported. Mainly flowing to South America, Oceania, Canada, and some parts of Europe

Northeast Asia: Long term oversupply, export-oriented. Mainly flowing to regions such as Oceania, Southeast Asia, Africa, and North America

Western Europe: In short supply, the proportion of imports has increased, and Western Europe mainly flows to the European region, importing from China and the United States

South America: Long term supply shortage, dependence on large imports, and a trend of moving from the United States to Asia

Middle East: mainly flowing to Oceania, Africa, and Southeast Asia

Liquid alkali trade flow

The United States is the world's largest exporter of liquid alkali, accounting for 35% of global liquid alkali trade annually. As the world's largest producer of caustic soda, China ranks second in export volume. The main import regions for global liquid alkali are countries such as Australia. Among them, the import volume of Australian liquid alkali accounts for more than 1/5 of the global liquid alkali trade volume, mainly from China and the United States. The export volume of caustic soda products in the Indian region exceeded the import volume for the first time in 2021, and its trade flow changed. The local caustic soda export volume continued to increase in 2022.

Importing countries: Brazil, Australia, United States, Netherlands, Finland, Sweden, Italy, and France are the eight largest importers of liquid alkali (2022)

Exporting countries: The United States, China, and Japan are the main exporters of liquid alkali (2022)

Solid alkali trade flow

Importing countries: Nigeria, Indonesia, Türkiye and the Republic of Congo are the main importing countries of solid caustic soda, and the solid caustic soda import volume of each country is small and scattered. (2021)

Exporting countries: China is the largest exporter of solid alkali, followed by countries such as India, Iran, Poland, and Russia. (2021)

Analysis of Major Overseas Imports and Exports

The United States: the largest exporter of caustic soda. In terms of export regions, Brazil accounts for half of the export volume, while Australia and Mexico are the main export destinations. In recent years, the export volume has slightly decreased.

Export destinations: mainly exported to Brazil, Australia, Mexico, and Canada, with Brazil accounting for 51.7% of the US caustic soda exports in 2022. (2022)

Export volume: In 2022, the United States exported 5.62 million tons of caustic soda, a year-on-year decrease of 2.3%, with liquid alkali being the main export. From the perspective of export destinations, the quantity of exports to Australia will decrease in 2022, while the quantity of exports to Brazil will steadily increase.

Australia: the second largest importer in the world, second only to Brazil. The main source of alkali consumption growth comes from alumina.

In 2022, they each accounted for 27.9%, 26.01%, 22.62%, 14.25%, and 9.21%.

Indonesia: The import volume of liquid alkali is rapidly increasing, mainly from China and Japan. Benefiting from the development of Indonesia's alumina industry, the caustic soda gap is expected to continue to expand in the future, and the Chinese export market is expected to expand.

In 2022, the proportion of Indonesian liquid alkali imports from China and Japan accounted for 63.76%/30.19% respectively.

The above is the Sorting out the caustic soda industry chain (Part 1): Basic information and global supply and demand analysis we have listed for you. You can submit the following form to obtain more industry information we provide for you.

You can visit our website or contact us, and we will provide the latest consultation and solutions

Send Inquiry

Most Popular

lastest New

Send Inquiry

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.

Fill in more information so that we can get in touch with you faster

Privacy statement: Your privacy is very important to Us. Our company promises not to disclose your personal information to any external company with out your explicit permission.